BingX Hits 40 Million Users, Doubles Growth in 2025

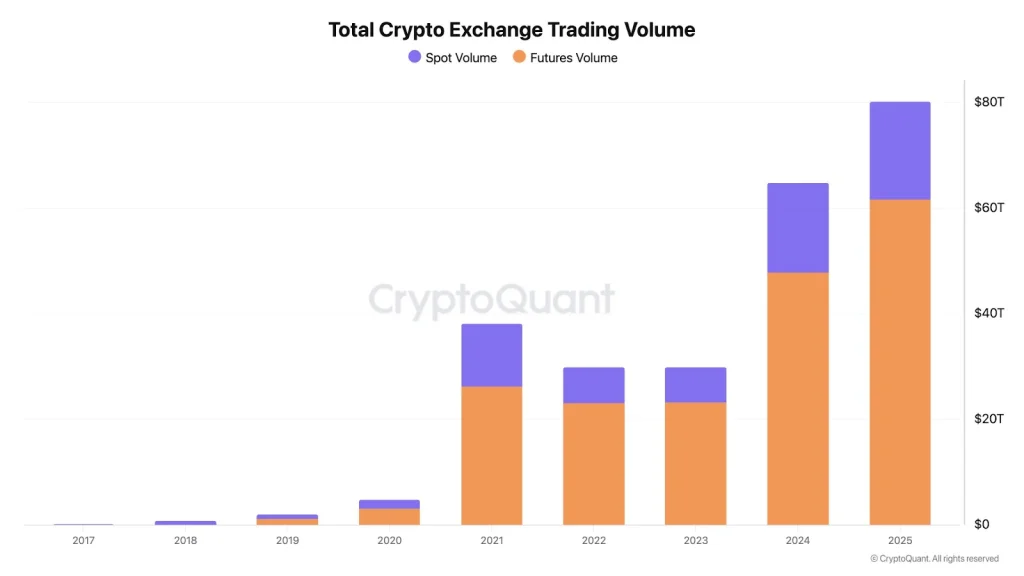

Cryptocurrency exchanges are experiencing an unprecedented surge in trading volume in 2025, catapulting them into a new era of growth. According to a comprehensive report from CryptoQuant, major exchanges like Binance and Bybit have collectively surpassed a staggering trading volume of over $79 trillion this year.

Binance Perpetual Trading Fuels Growth in Crypto Volume in 2025

The driving force behind this dramatic increase can be traced back to Binance. In 2025, the spot trading volume on Binance climbed to approximately $18.6 trillion, marking a significant 9% increase compared to the previous year. This growth is noteworthy as it indicates that more users are turning to spot trading as a preferred method for engaging with the cryptocurrency market.

However, the real star of the show has been perpetual futures trading. The report highlights that the perpetual futures trading volume reached about $61.8 trillion in 2025, showcasing a remarkable 29% increase from the prior year. This explosive growth has underscored the increasing demand for margin and leverage trading options, especially given the volatility prevalent in cryptocurrency markets.

The significant increase in trading volume aligns closely with the preferences of traders. Binance has become a key player, accounting for roughly 41% of the combined spot trading volume among the top 10 centralized exchanges (CEX). Traders have primarily gravitated towards popular cryptocurrencies like Ethereum (ETH), XRP, BNB, TRX, and Solana (SOL).

Additionally, Binance’s dominance in perpetual futures cannot be overstated. The exchange recorded a whopping $25.4 trillion in Bitcoin perpetual futures volume alone, representing an impressive 42% share of the trading volume among the top exchanges. In terms of stablecoin liquidity, Binance holds a robust position with $47.6 billion in USDT and USDC reserves, accounting for around 72% of stablecoin balances across the leading exchanges.

What’s Next?

Looking ahead, the momentum in trading volume is set to persist into 2026. A clear and stable regulatory environment is anticipated to pave the way for increased participation from institutional investors. As these investors become more comfortable with the landscape, their capital allocations to cryptocurrencies are likely to surge, further boosting trading volumes.

Moreover, the crypto space is buzzing with anticipation regarding the potential enactment of the Clarity Act in 2026. This act aims to provide clearer guidelines for cryptocurrency regulation, which may contribute to greater confidence among both retail and institutional investors. With initiatives like the Genius Act already in its implementation phase, exchanges could be in an excellent position to record even higher trading volumes as we move through the year.

As the cryptocurrency market continues to evolve, the development of new trading products, coupled with the increased participation of diverse investor groups, suggests that 2026 could be another record-breaking year for crypto trading volumes. The landscape is ripe for innovation, with endless possibilities on the horizon for exchanges and their users alike.

CoinPedia has been a trusted source for accurate and timely updates in the cryptocurrency world since 2017. Each article is crafted by a team of experienced professionals dedicated to delivering news and analysis based on strict editorial guidelines. Always remember, however, to do your own research before making investment choices, as the cryptocurrency market can be highly volatile.